Whether you’re trying to get a house, a condo or an apartment, renting accommodations in the BVI can be costly. Although there are lots of available living spaces to rent, finding one that meets your needs, is affordable and within your budget can be a major challenge. Apartments with reasonable rental costs, in particular, are in high demand. Rent for a two bedroom apartment can run anywhere from $800 to $2,500 dollars per month while studios can go for as much as $700.

Accommodations in some select areas close to Road Town are popular and rents are often higher in those places than in more remote areas. Hillside, breezy, ocean view rental properties with all the amenities, like swimming pool, air-conditioning, and washer and dryer can also cost a bundle. To find an apartment in your ideal location, with your desired amenities, and at the right price will require research. You also have to consider transportation issues. Renting an apartment with the best hillside view and all the amenities in the world but which is not accessible by regular transportation would not be the smartest option, especially if you do not drive. Also, if the location requires four-wheel drive to access but your car doesn’t have it, you might want to reconsider.

How much rent should you pay?

Determine from your monthly take-home income and current expenses, how much you can afford to spend on rent. Financial experts advise that your annual income should be at least 40 times your monthly rent. For example, if your rent will be $1,000 per month, your annual income should be at least $40,000. Other experts recommend that your annual housing expenses should be no more than 25 to 30 percent of your income. If your income is $40,000; then 30 percent of that would be $12,000. Your monthly rent should be no more than $1,000 ($12,000 divided by 12 months). Whichever calculation you use, you should end up with the same amount for your estimate to spend on rent. Using this formula, you should be able to cover your other living expenses and still have enough to contribute to your savings. Don’t forget to include upfront costs in your rental budget. If the rental is unfurnished, you will need to include furnishing costs in your budget as well.

Most landlords will expect you to pay two months’ worth of rent in advance. One is held as the deposit in case of damage or other costs (so you’ll get it back when you leave the property, minus any charges), and the other is your first month’s rental payment. Some landlords ask for a larger deposit to take account of unpaid bills. Make sure you have enough money before you start looking around to avoid disappointment.

Some Quick Budgeting Tips

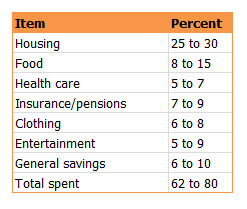

Below is a short table you can use as a guide to determine what percentage of your income should be spent on some of your other basic necessities. These percentages will vary depending on your individual needs. One of the challenges with renting is finding living accommodations that costs no more than 30 percent of your income. Shopping around and possibly getting a roommate to share the rental costs can be a viable option if you’re having trouble finding housing that meets both your desires and your budget.

Also factor in the cost of utilities. The cost of water in the BVI starts at $12 for your first 1,000 gallons and $15 dollars on the second thousand. Over 3,000 gallons is worked out at $18. Electricity fluctuates and varies according to the price of fuel. You can reduce utility costs by using energy saving measures.

See section on Budgeting for more information.

Finding a Property

You can find rental properties by using real estate agents, looking in newspapers, on the online news sources, or driving around the island to look for “for rent” signs. Compare rents of similar properties in the same areas so you know if you’re getting a good deal. Note the available options in your price range. Be prepared to call places of interest immediately and make a serious inquiry. Arrange to see the place and determine whether the rental price meets the value of the place. It’s important to already have funds set aside to make your down payment.

Rental Lease Agreement

You can choose to rent from a private landlord or from a realtor. Properties managed by realtors tend to be a bit pricier because their management fees are included. Some people prefer realtors as they tend to respond more quickly to problems, such as painting, roofing, maintenance, and securing the property before a storm or hurricane. Ask previous or existing tenants about the landlord or realtor’s behavior towards managing the property before you sign the rental agreement.

Make sure you have a rental lease agreement clearly stating the responsibilities of both the tenant and the landlord, and read your lease agreement very carefully before you sign it. You will be held accountable for knowing everything included in the lease, even if you never read it! Keep a copy of the lease for your records. It may come in handy if you have a question about what you are or are not allowed to do. Secure a parking space in your agreement.

Make sure any existing problems are taken care of before you move in.