Save for a Time

Living below your means or living frugally is a great way to save. However, it’s important to give yourself some flexibility so saving doesn’t feel like a punishment that’s taking away all of life’s goodies. You can tighten your budget for a specific time while you save for a short term goal. For example, you can cut your spending for six months until you’ve saved enough money for a down payment on a car; once you’ve met that goal, you can be more relaxed about your spending or, now that you’ve seen where it’s possible to cut back, you can continue to save and put the extra money in a CD or mutual fund.

Financial experts say saving is important to your financial security and well-being. Knowing you have money saved in case of an emergency or unexpected expense, to help with a future purchase, or for when you stop working, can give you peace of mind.

According to the experts, the amount you should be saving depends on your age, your current income, your plans for the future and for retirement, your current assets, your current amount of debt, the return you expect on your money, and other factors.

Put it on Automatic

One of the best ways to guarantee that you save is to have money deducted automatically from your salary and sent to an account that is not easily accessible. You can ask your employer to split your salary; half can be automatically deposited in your checking account or the one from which you pay your bills and half can be deposited in an interest-bearing savings account. You can also set up automatic transfers from your checking to your savings account. It’s best if you do not have an ATM card access to your savings account so you’ll be less tempted to make impulsive withdrawals. The harder it is to get the money from your savings account, the more likely you are to leave it there to accumulate and grow. Depending on your saving goal, you might also put the money in a CD or savings club account to get higher interest rates.

Save for a Rainy Day

Life can be unpredictable so you should always be prepared for emergencies. Having a “rainy day” or emergency fund is very important. Your emergency fund should be your first saving goal. Financial experts used to recommend that you have enough money in your emergency fund to cover between three to six months worth of living expenses. With the financial crisis leaving more people unemployed for longer periods, some experts now say that your rainy day fund should cover at least eight months of living expenses, especially if you have a family.

Set Goals

Look at your budget and subtract your must-have or essential expenses from your take-home pay to see how much money you have left over. This amount will give you an idea of the approximate amount you can afford to save. Let’s say you take home $3,000 a month, and your essential expenses (rent, gas, electricity, food, water, car loan, etc.) are $2,400 a month. That leaves you with $600 to save, which is 20 percent of your take-home income. You may decide to save half of that - $300, which is 10 percent of your take home income – and use the remainder for discretionary spending.

Financial planners, however, recommend that you save or invest a minimum or 10 to 15 percent of your take home income. You can vary this according to your age and saving goals. If you are a 25 year-old college graduate, you may want to save 10 percent and use the rest to travel and explore life for a couple of years. If you are a 35-year-old family man with children and you want to build your own home before you reach age 42, you can save the full 20 percent for the next five years and have a down payment of at least $36,000 to start building at age 40. ($600 saved monthly = $7,200 a year = $36,000 in five years).

The Power of Compound Interest

If there’s any magic in saving, this is it – the power of compound interest. When you’re saving, interest is regularly added to your savings (usually every month). If you don’t touch the interest, but let it add to your savings, then you start to earn interest on your interest, as well as on the original amount you saved. The longer you leave your money, the more powerful the compound interest effect. So the earlier you start saving, the more you make.

Think you can’t save?

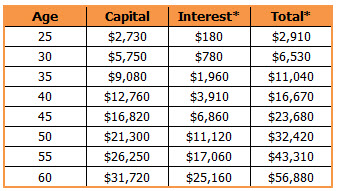

If you save $10 a week from age 20, by age 25 you will have saved more than $2,700. Here’s how it will grow with compound interest.

*Rounded to the nearest $10

You’ll have $56,880 by the time you’re 60.

Results are in nominal dollars, based on net real rate of return of 2.5% p.a.

Saving Tips

- Pay yourself first – have the money you plan to save automatically deducted from your monthly paycheck before you pay any other bills.

- Only spend 60 percent of your take-home income on bills and other living expenses and save and invest the rest.

- Downsizing to a less expensive apartment or refinancing your mortgage can get you closer to your savings goal.

- You live in a tropical weather zone, so you don’t have to change clothes every season – wear your clothes until they are worn out.

- Buy clothes that are durable and that you can wear year in and year out. Stay away from the latest styles or trends.

- Buy with cash – it’s easier to see your money running low with cash than if you use your debit or credit card.

- Have one car per household – you don’t need to have three cars for a three person household. It may take some organizing and compromise, but it’s doable. Honestly, traveling distances in the BVI are relatively short.

- Keep a jar to put your spare change in and deposit the money in your savings account every month or two.

- Teach your children about budgeting early and have them save up for their next Nintendo.

- Buy in bulk, especially if you have a big family. Try to go shopping every two weeks and try to use all the food in your cupboards before you go shopping.

- Buy daily snacks in bulk at the grocery store; it’s much cheaper than buying them at the convenient store every day.

- Get a prepaid cell phone, it might be cheaper than a monthly plan - set your phone budget and use only that amount each month. Top up on double top up days to get more bang for your buck.

- Get Skype, Google talk or one of those free internet phones – make free calls to anywhere in the world.

- Set a limit for birthday and Christmas presents.

- Cook lunch for at least three days out of the week. If you’re one of those who put in long hours on the job, try cooking your lunches on weekends and freeze each portion separately.

- Have a potluck dinner or have people over for dinner instead of going to a restaurant. Plan your party at your own home.

- Have a staycation; instead of traveling far distances for your vacation and having to pay airfare and other transportation costs, take advantage of the packages offered by local hotels and save yourself a bundle. We have lots of hotels on the different islands to make you feel like you’ve left the BVI. Instead of flying to go on a cruise, charter a yacht and sail around the BVI; you’ll be amazed at all there is to see and experience right here in the BVI! Act like a tourist and visit the BVI.

Keep Saving!

Keep saving; it’s possible to achieve your millionaire dreams. The longer you save, and the more you save, the closer you’ll get to your dreams.