It’s never too early to start planning for your retirement. The earlier you start, the larger your nest egg will be when you are ready to retire. If you have a target age of when you would like to retire, you need to take into consideration the rate of inflation and cost of living increases to estimate how much money you’ll need to live comfortably during your retirement. Use the savings calculator to estimate how much you can save if you start saving today. Add up all your retirement savings, investments, pension fund and expected age benefit from Social Security to see if you are on the right track toward planning for your retirement. Use this retirement calculator to determine if additional savings are required.

What is a pension plan?

Do you have a pension plan? A pension plan is a type of retirement plan in which an employer and/or employee contributes to a pool of funds set aside for an employee’s future benefit. The funds are invested on the employee’s behalf, so you can get the benefits once you retire. Essentially, it provides you with a regular paycheck when you’re retired and no longer working.

There are two main types of pension plans: defined-contribution plans and defined-benefit plans. In a defined-contribution plan, the employer makes a predefined contribution for the employee, but the final amount of benefit received by the employee depends on the performance of the invested funds. In defined-benefit plans, the employer guarantees that the employee will receive a defined amount of benefit when they retire regardless of the performance of the invested funds.

Does your employer have a pension plan?

Under the Labour Code 2010, employers in the BVI are required to provide retirement benefits to permanent employees by means of a “pension scheme, an annuity, provident fund or other form of retirement scheme.” You should take advantage of any retirement investments your employer may offer you. If you are eligible, check with your employer to see which retirement plan is being offered and how you will benefit from it.

The Labour Code also states that even if your employer doesn’t provide a retirement plan, you are still entitled to retirement benefits if you have been with an employer for at least 10 years and you retire at age 65 or at an agreed retirement age. The code requires that you are paid retirement benefits calculated on the following basis:

- nine days pay for each completed year of service after the Code came into effect;

- three days’ pay for each completed year of service for the first ten years of service before the Code came into effect;

- four days’ pay for each completed year of service between 10 and 20 years’ service before the Code came into effect;

- five days’ pay for each completed year of service between 20 and 30 years’ service before the Code came into effect; and

- six days’ pay for each completed year of service beyond 30 years’ service before the Code.

If you are now under a pension plan that was established by your employer after the Code and you have been with your employer at least 10 years before the Code, you will be eligible for benefits under the pension plan as well as the benefits calculated on the basis above.

Social Security

On retirement, you should also be eligible for an age benefit from Social Security if you were insured under the Social Security scheme. Remember, everyone between the ages of 15 and 65 years employed in the BVI, must register with the Social Security Board. Once you have registered, you’re always registered. You and your employer must make contributions for you to be insured.

An Age Benefit is paid to an insured person who has reached the age of 65 and has satisfied the necessary contribution requirements. Age benefit is awarded in the form of a pension or a grant.

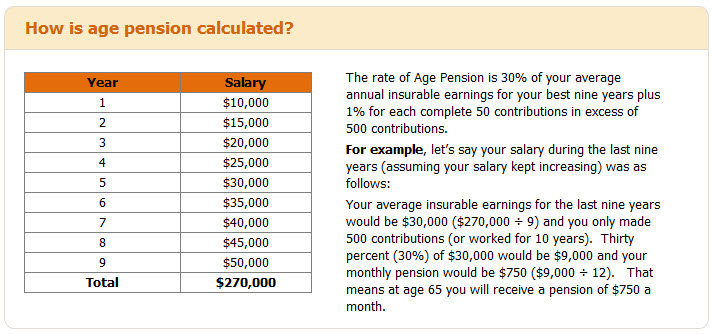

How to qualify for an Age Pension?

To qualify for an Age Pension you must:

- be 65 years.

- have paid at least 500 contributions (10 years).

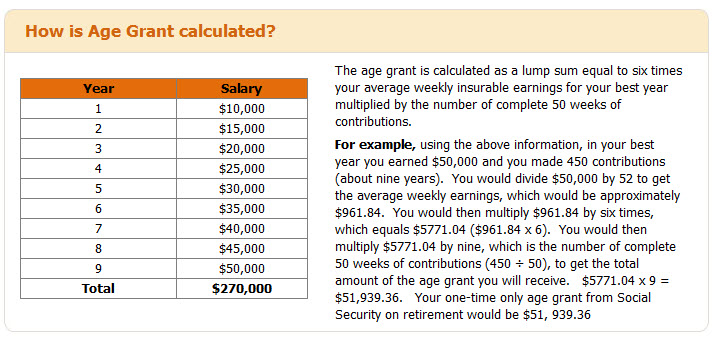

How to qualify for an Age Grant?

To qualify for an Age Grant you must:

- be 65 years.

- have paid at least 50 contributions (1 year) but less than 500 contributions (10 years).

Age and Survivor’s benefits can be paid concurrently

If you qualify for an Age benefit, and you are in receipt of/or qualify for a Survivor's benefit you will receive the Age benefit and half of the Survivor's benefit.

How to claim for an Age benefit?

To claim your Age Benefit, you must complete the Age Benefit Claim Form and submit it to the Social Security office within three months of your 65th birthday. Attach a copy of your Birth Certificate or other proof of birth and your Social Security Card.

It is important to note than an Age Benefit is not a retirement benefit. You may continue to work while receiving an Age Benefit. No contributions should be deducted from your salary if you continue to work after age 65. However, your employer must contribute 1/2 % of your insurable earnings, as coverage for employment injury.

Once you were insured by the BVI Social Security and have met the qualifying contribution conditions, on retirement, you will receive an Age Benefit from Social Security wherever you are in the world.

Retire with confidence

Financial advisers recommend that you have at least three sources of retirement income – your pension, savings and investments, and Social Security. Start your financial planning today to make sure you can retire with confidence!